Comment les taxes environnementales peuvent-elles accroître la durabilité de la croissance économique dans les pays à faible revenu ? Les taxes environnementales peuvent être définies comme toute taxe imposée sur une base dont l’impact négatif sur l’environnement est avéré, par exemple les droits de douane à l’importation sur les matières plastiques, les taxes sur les embouteillages ou les accises sur les engrais. Ils ont été largement promus comme un moyen de réduire les dommages environnementaux tout en augmentant les revenus des pollueurs. Parce qu’ils sont généralement calculés sur des produits et des volumes tangibles, ils sont également souvent considérés comme plus difficiles à éluder que d’autres impôts basés sur des concepts plus abstraits, ce qui en fait des instruments attrayants pour les pays à faible revenu. La taxe environnementale qui a fait le plus l’objet de discussions est sans aucun doute la taxe carbone, qui est prélevée sur la teneur en carbone de différents biens, fortement corrélée à la quantité de combustibles fossiles nécessaires à leur production. Les taxes sur le carbone sont considérées comme un outil essentiel pour réduire les gaz à effet de serre, et leur introduction fait l’objet d’un soutien presque universel dans le monde entier. Cela inclut l’Afrique subsaharienne, avec les Nations Unies, le Fonds monétaire international et l’OCDE qui promeuvent tous leur mise en œuvre dans divers pays de la région à différents moments. La taxation du carbone à la rescousse : mais l’est-elle vraiment ? Cependant, il y a peu de preuves que les gouvernements africains les considèrent comme une priorité nationale. Selon le tableau de bord de la tarification du carbone de la Banque mondiale, seuls le Gabon et le Sénégal envisagent actuellement leur introduction, après l’introduction d’un tel tableau en Afrique du Sud en 2019, qui n’a sans doute pas abouti à grand-chose à ce jour. En soi, ce n’est pas surprenant, car l’Afrique a les émissions par habitant les plus faibles au monde

Read MoreNEWS

Tax News in congo....Actualités Impôts en rdc

The KPMG RDC SA firm is pleased to invite you to a webinar that it is organizing on January 9, 2024 from 10:00 a.m. to 11:30 a.m. GMT+1 on the innovative measures introduced by the finance law for the 2024 financial year. Under the moderation of our Tax and legal team, this webinar will be hosted by Luison KIYOMBO, Managing Director of KPMG RDC SA and Partner with proven experience in tax and legal matters. This bilingual and interactive webinar will allow participants to understand the impact of these innovations on the tax management of their companies' operations, with practical cases. Authorized persons from the Tax Administrations will be involved in the debate. participation is free upon prior registration

Read MoreArticle 1: This Order establishes the conditions for being subject to value added tax by option in application of the provisions of Article 14 of Ordinance-Law No. 10/001 of August 20, 2010 establishing the tax on added value, as amended and supplemented to date. Article 2: Legal entities and natural persons whose annual turnover is below the value-added tax liability threshold may opt for the value-added tax regime.

Read MoreThe introduction into the structure of the Congolese tax system of corporate tax and personal income tax calls for the modification of law n°004/2003 of March 13, 2003 relating to tax procedures. These modifications relate particularly to the provisions relating to reporting obligations, the methods of exercising control and the methods of recovery. With regard to reporting obligations, this law introduces a provision concerning: - the declaration of corporate tax and tax on natural persons; - the declaration of withholding tax on personal income in the categories of salary and similar income, income from movable capital and capital gains realized by natural persons;

Read MoreLadies and Gentlemen, Discover the 500 innovations introduced into tax, customs and non-tax revenue procedures between 2003 and 2023. Our work presents these major developments in the form of a comparison table between the old provisions and the new reforms, thus offering a clear and concise vision of the changes that have occurred. Take advantage of this invaluable resource now for just $200.

Read MoreUN countries today overwhelmingly adopted a resolution to begin the process of establishing a framework convention on taxes and completely change the way global tax rules are decided. The framework convention could eventually transfer decision-making on global tax rules from the OECD – a small club of rich countries where it has sat for more than 60 years – to the UN. “This is a historic victory won by the countries of the South, for the benefit of people around the world. Tax havens and corporate lobbyists have had too much influence on OECD global tax policy for too long.

Read MoreThe General Directorate of Taxes reminds companies in the mining sector that the payment deadline for the fourth installment in respect of the tax on profits and profits (IBP) for the 2023 financial year occurs no later than this Thursday 30 Number 2023.

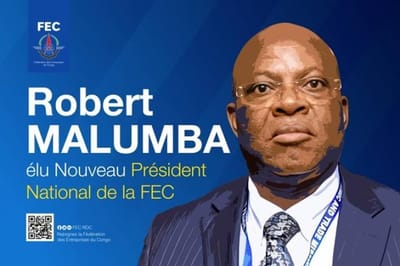

Read MoreAt the end of the elective general assembly this Monday in Kinshasa, the businessman Robert Mulamba has just replaced Albert Yuma at the head of the Federation of Congolese Enterprises (FEC). Albert Yuma, who spent 18 years as president of the FEC, was not a candidate for his own succession.

Read MoreIn the event of late filing of a declaration, the law provides in its Articles 29 and 30 the following Article 29 Article 89 of Law No. 004/2003 of March 13, 2003 on Reform of tax procedures is amended as follows: "Article 89: When the defaulting debtor regularizes his situation before receiving formal notice to declare and within the time limit set in Article 5 of this Law, only an increase equal to 25% of the amount of tax declared

Read MoreSpecific agreement relating to tax and customs facilities between the Democratic Republic of Congo, represented by Mr. Nicola KAZADI KADIMA NZUJI, Minister of Finance, duly authorized; and the national episcopal conference of Congo, CENCO in acronym duly mandated by the Holy See, represented by its president Monsignor Marcel UTEMBI TAPA

Read MoreFollowing the urgent measures which were taken during the one hundred and fifth meeting of the Council of Ministers on July 21, 2023, in particular the payment of all taxes, fees and duties due to the State in Congolese francs, I have the advantage to inform you that, on the instructions of his Excellency President of the Republic, Head of State, mining companies must sell the share of their currencies repatriated to the central bank of Congo in exchange for Congolese francs on the basis of a rate .

Read MoreThrough correspondence addressed to its central, urban and provincial directors, the General Directorate of Administrative, Judicial, State and Participation Revenue (DGRAD) announced the rate of fees to be paid and the modalities for the issuance of the secure biometric driving license and with chip in the DRC, in accordance with the interministerial decree of August 2, 2023, signed by the ministers of transport Marc Ekila and finance Nicolas Kazadi.

Read More