Desirous of concluding a convention for the avoidance of double taxation and the prevention of tax evasion and evasion with regard to taxes on income and on capital.

Read MoreNEWS

Tax News in congo....Actualités Impôts en rdc

Digital transformation stimulates innovation, generates productivity gains and improves services while promoting more inclusive and sustainable growth and improved well-being.

Read MoreArticle 17: Paragraph 1 and paragraph 4 of article 84 of Ordinance-law n ° 69/009 of February 10, 1969 relating to schedule taxes on income are amended as follows:

Read MoreAfter 5 years of a collaborative approach to discussing the issues of wealth gaps, TaxCOOP is broadening its horizons by organizing the World Tax Summit - TaxCOOP2020, from October 13 to 15, 2020.

Read MoreThe OECD will present on Monday, October 12, 2020 at 11:00 a.m. (Paris time, 9:00 a.m. GMT) an update on the progress of the negotiations led by the 137 members of the Inclusive Framework on BEPS to reach a multilateral and consensual solution to the challenges taxes linked to the digitization of the economy.

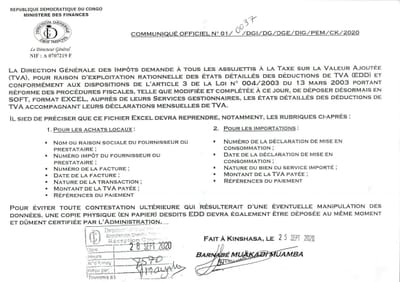

Read MoreThe official journal of the Democratic Republic of Congo published on September 15, 2020, a decree relating to the method of payment of debts to the State.

Read MoreYou will find in this table, the different depreciation rates for buildings, vehicles, etc ...

Read MoreGOVERNMENT Prime Minister's Office June 13, 2013 - Decree No. 13/020 conferring the status of town and municipality to certain agglomerations of the Province of Katanga,

Read MoreThe taxation of land in the Democratic Republic of Congo - Case of the city of Kinshasa.

Read MoreNon-profit organizations are taxed on the basis of Law n ° 004/2001 of July 20, 2001 laying down general provisions applicable to non-profit associations and public utility establishments.

Read More